Connect & track all your accounts

Sync and manage your financial info from 14,000+ financial institutions.

Customers for over 40 years

Best Mint Alternative

Best budgeting app

Best personal finance app

Understand spending habits

Understand spending habits

Manage subscriptions

Manage subscriptions

Save more

Save more

Pay down debt faster

Pay down debt faster

Grow investments

Grow investments

Improve net worth

Improve net worth

Manage cashflow

Manage cashflow

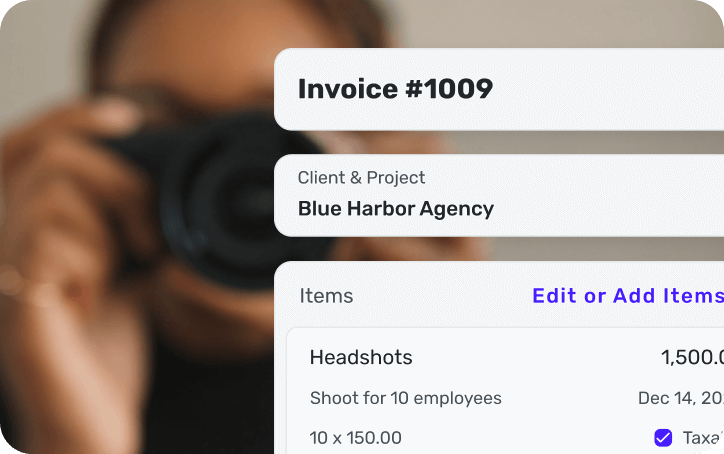

Get paid faster

Get paid faster

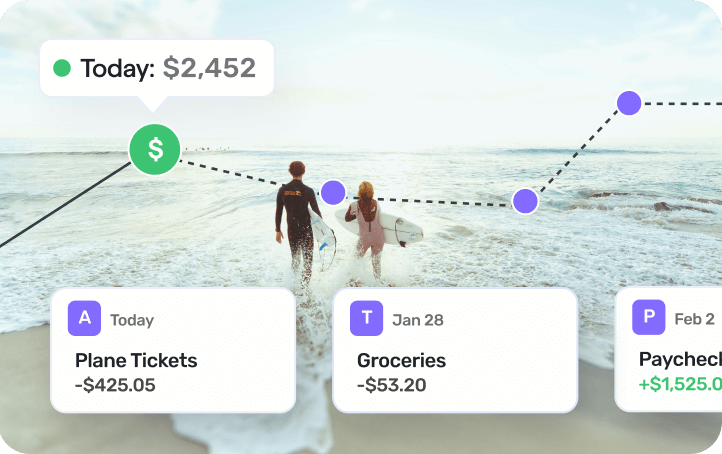

Connect & track all your accounts

Sync and manage your financial info from 14,000+ financial institutions.

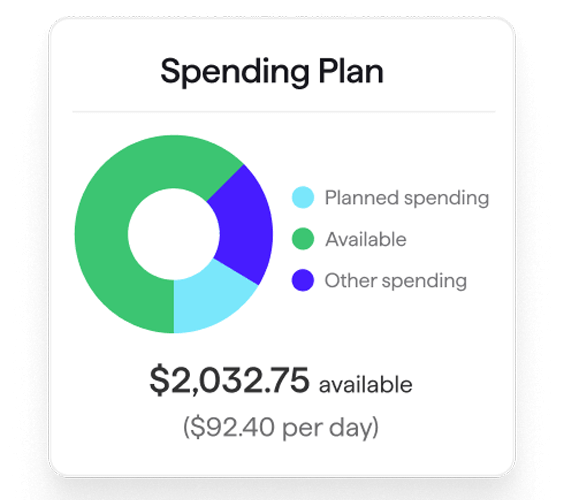

Spend & save with confidence

No matter your budget or savings goals, dial them in with Quicken

Tap 手机查询168官方开奖直播 insights you can act on

Generate future-focused reports and analyses for smarter decisions.

Build the future you want

Manage investments, retirement plans, and your entire portfolio.

168体彩站飞艇 Quicken

Quicken Business & Personal

Classic Premier

Classic Business & Personal

Trusted for over 40 years

#1 best-selling with 20+ million customers over 4 decades.

Bank-grade security

We protect your data with industry-standard 256-bit encryption.

Your privacy matters

Rest assured, we’ll never sell your personal data.

No surprise charges or ads

No hidden fees or annoying ads. What you see is what you get.